Frequently Asked Questions

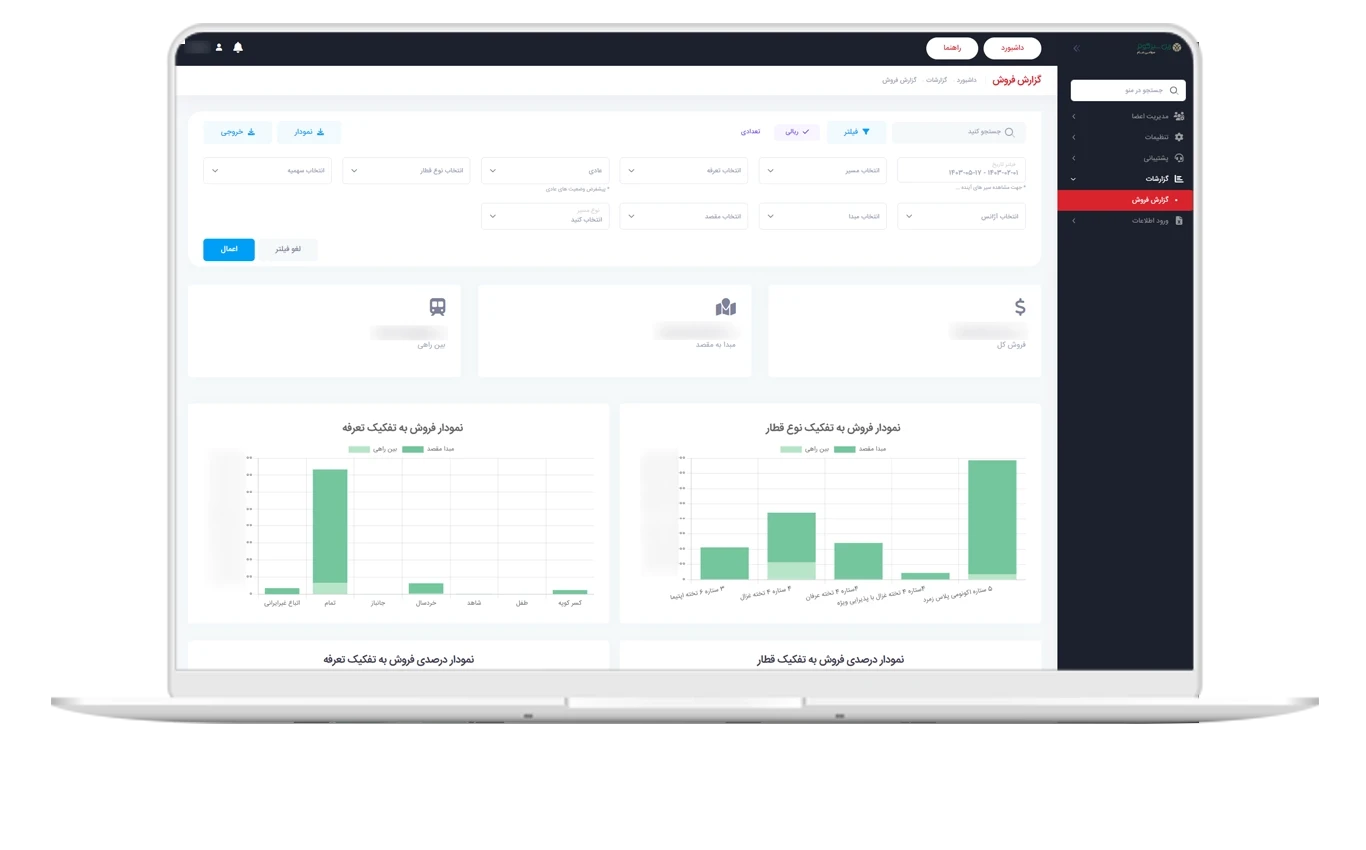

Management Panel or Regular Reports? Which One Do You Need?

Data is essential for modern organizations to thrive, regardless of industry. Understanding your ecosystem and stakeholders through data-driven insights is critical for success and growth.